Central Board of Excise and Customs has issued a circular for the migration of Central Excise/Service taxpayer to migrate to GST.

As you all are aware that GST would be rolled out from 01.04.2017, the taxes from then would be submitted to GST from Central Excise/Service tax. In case you are registered with the State Commercial Tax Department (VAT/Luxury Tax/Entry Tax/Entertainment Tax), you need not the submit the migration process and no other procedure will be applicable to you.

How to Migrate to GST?

- To migrate to GST, the first thing you need to have is the Provisional ID and password. All the existing Taxpayers will be provided with a Provisional ID. The Provisional ID can also be obtained from the state VAT department.

- Login to GST portal using the Provisional ID and password.

- Fill the required details and upload the supporting documents

- Then, an Application Reference Number (ARN) will be generated by the GST

- Then, on the specified GST roll out date, you will be successfully migrated to GST with the provisioning certificate.

Process to Obtain Provision ID

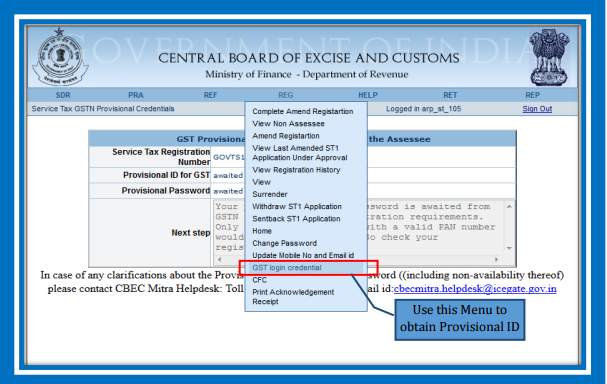

Step 1: Logon to ACES portal using your existing ACES User ID and Password

Step 2: Either click 'Follow this Link' to obtain the Provisional ID and Password OR navigate using the Menu

Step 3: Note down the Provisional ID and password that is provided. In case a Provisional ID is

not provided, please refer the Next Step section.

Once you received the Provisional ID and Password, login to the GST Common Portal

(https://www.gst.gov.in) using this ID and Password.

No comments:

Post a Comment